Eat Sleep Blog Repeat

Dean Shepherd

A Chartered Tax Adviser and accountant, Dean has been in the accounting profession for over 25 years. Working both in accounting practice and with the UK’s leading tax software providers. Now back to doing what he loves - helping creative professionals take control of their finances, understand their numbers and pay the right amount of tax.

Recent Articles

- Dean Shepherd

- September 17, 2025

Most people set up a limited company because it separates their personal finances from the business. In almost all...

- Dean Shepherd

- September 15, 2025

For many creative entrepreneurs, the dream of a garden office is strong: a bright, stylish studio just a few steps from...

- Dean Shepherd

- September 12, 2025

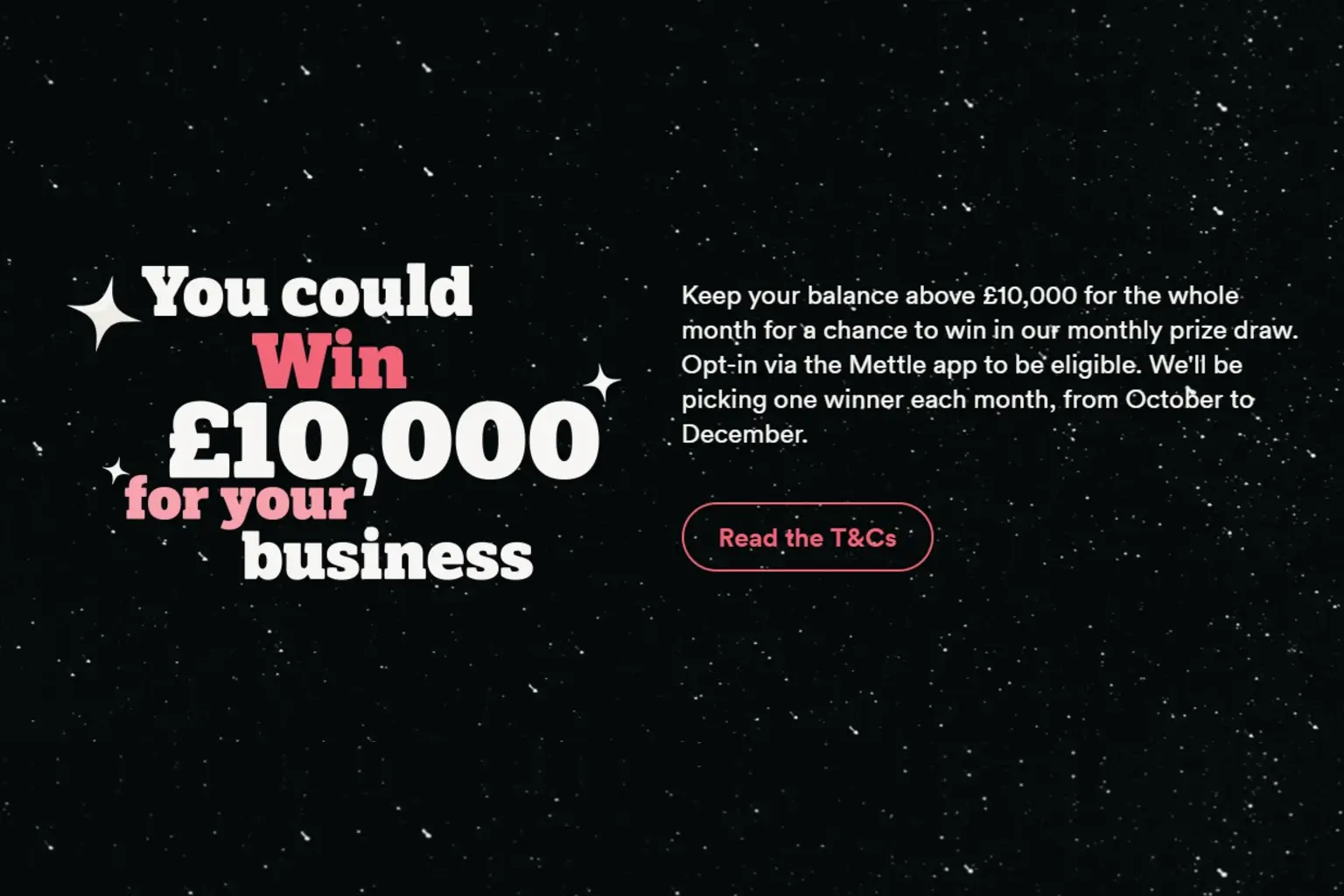

A few banks now run prize draws to encourage you to keep a healthy balance. One of the most eye-catching is Mettle’s...

- Dean Shepherd

- September 3, 2025

Running a small creative business in the UK comes with its unique challenges, and keeping your team happy and...

- Dean Shepherd

- September 2, 2025

Creative businesses often love to surprise clients (and impress prospects) with thoughtful treats – a box of artisan...

- Dean Shepherd

- September 1, 2025

If you run a creative business — whether that’s a design studio, film crew, or production agency — you want your team...

- Dean Shepherd

- August 26, 2025

If you’re an interior design studio that sources furniture and furnishings for clients, VAT can get messy fast. The key...

- Dean Shepherd

- August 22, 2025

Running a creative business means juggling big ideas, tight deadlines, and sometimes unpredictable income. Tax might...

- Dean Shepherd

- August 21, 2025

When you employ people, you’ll know that PAYE is the system for deducting tax and National Insurance from salaries. But...

- Dean Shepherd

- August 20, 2025

When you’re starting or growing a creative business, your bank account might not be the first thing on your mind....