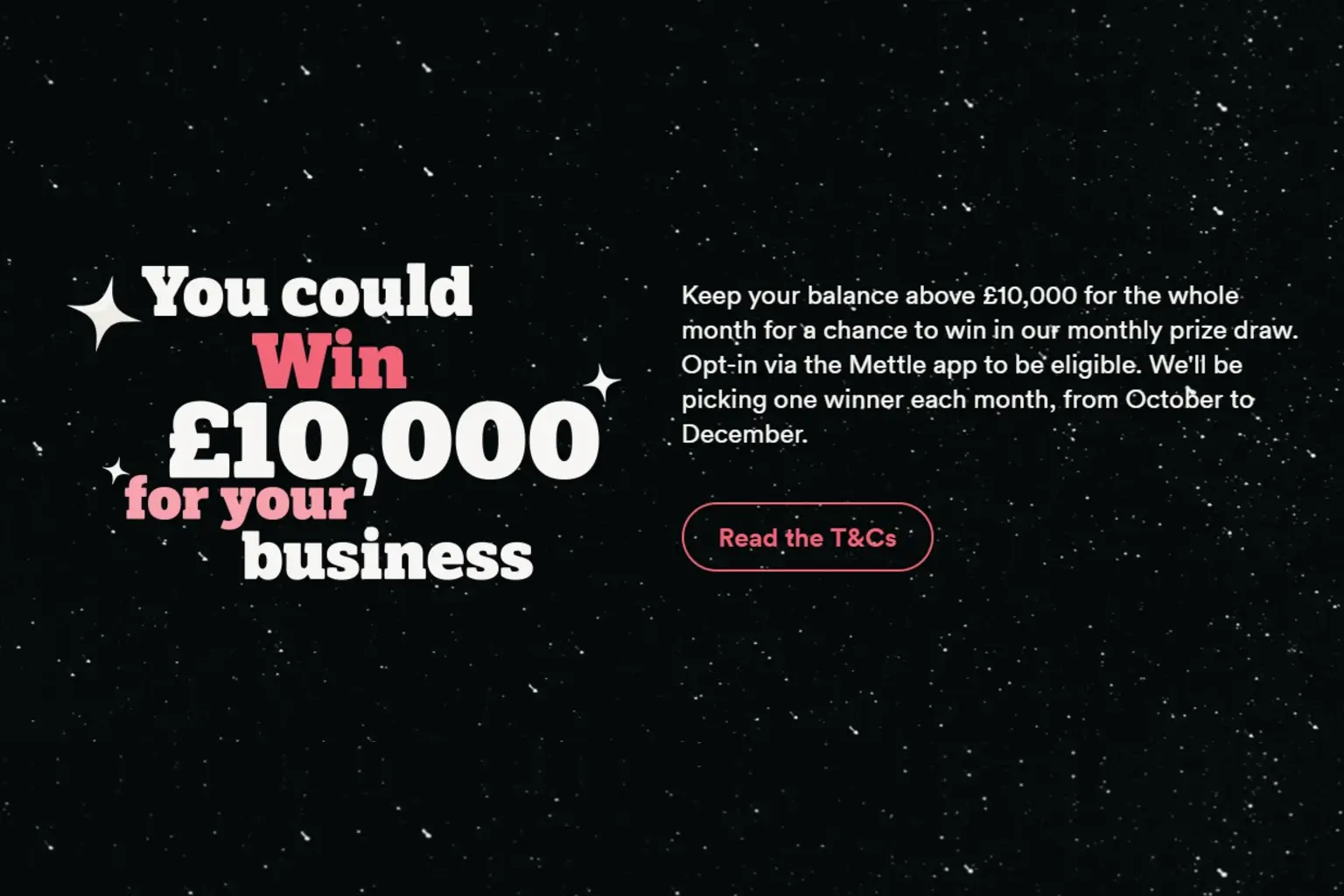

A few banks now run prize draws to encourage you to keep a healthy balance. One of the most eye-catching is Mettle’s “keep £10,000 in your account and you could win £10,000.” For a small creative business, that sounds like a dream: you’re holding cash for projects, and suddenly the bank calls to say you’ve won a five-figure sum. But before you celebrate, it’s worth knowing how HMRC will view that windfall.

How HMRC sees a business prize draw win

Although the prize feels like a windfall, HMRC doesn’t treat it in the same way for a business as it does for an individual. For personal customers, lottery wins and Premium Bond prizes are tax-free. For a business, however, the £10,000 isn’t a personal flutter — it’s a sum received in the course of your trade because you were holding your business’s money in that account. HMRC’s published guidance on prizes and incentives says that where a business receives a cash prize connected with its activities, it should be brought in as income for tax purposes.

In practical terms, that means if your company or sole trade business wins a £10,000 draw like this, you can’t ignore it for tax. You’d treat it as “other income” in your accounts, and it will be subject to Corporation Tax if you’re a company or Income Tax if you’re a sole trader. There’s no VAT to worry about because you’re not supplying anything, but it still forms part of your taxable profits.

Recording it properly keeps life simple

If your business wins, keep the bank’s notification and post the amount to an “Other income” code in your bookkeeping software. It then flows through automatically into your tax return. If you’re on Xero or a similar system, you can even set up a rule for “prize draw income” so it’s clear. That way you won’t get caught out at year end or trigger awkward questions from your accountant.

Is Mettle the right option for your business?

For many creative businesses, choosing a bank account isn’t just about fees — it’s about features and reliability. Mettle’s prize draw can be a fun extra, but it shouldn’t be the main reason for switching. Think about whether the account integrates well with your bookkeeping, how easy it is to pay suppliers or get help when something goes wrong, and whether the £10,000 balance requirement fits with your cash-flow patterns. If you tend to keep a healthy reserve and like the look of the features, then a chance of winning a prize is a nice bonus. But if you’re moving money in and out for shoots, freelancers and kit purchases, you may prefer an account that gives you better overdraft options or dedicated support rather than a chance of a windfall.

The bottom line

Winning £10,000 from your business bank might feel like free money, but for tax purposes it isn’t. If your business is the account holder, HMRC will see the prize as taxable “other income,” and it needs to be shown in your accounts just like any other receipt. With a little planning — and good bookkeeping — you can still enjoy the benefit without any nasty surprises at tax time.

Found that content useful?

Why not sign up for more good stuff!!